Structuring the First Home Super Saver (FHSS)

Proper structuring can allow the FHSS to be used without stock market risk and mixing investment allocation decisions

The concept of fungibility illustrates the importance of properly-structured finances. Fungibility means that if I lend you a physical $5 note, you do not have to give me back that exact $5 note when you repay the loan. You can provide a different $5 note, $5 worth of coins, a $5 bank account transfer, or - if I am willing to accept it - goods and services worth $5.

Fungibility’s relevance to the FHSS is that, when funds are released from one’s superannuation fund, there is no way of distinguishing which investment allocation options are actually released. Suppose with your super that you have retirement savings invested in high-growth, risky stocks and that your FHSS amounts are invested only in cash or fixed-income assets such as bonds. You may only want to use the cash-allocated contributions, those that make up your house-deposit savings, but the scheme, when a determination is made, sets the amount that can be withdrawn.

When super is ‘redeemed’ or, if you have ever rolled one superfund into another, a proportional amount is invested in each option you have made for your portfolio. If your super is allocated between 50% high-growth and 50% cash, the best way to conceptually think about this is that each dollar in the fund is apportioned between those options, rather than two separate pots of investments that can be used for specific purposes.

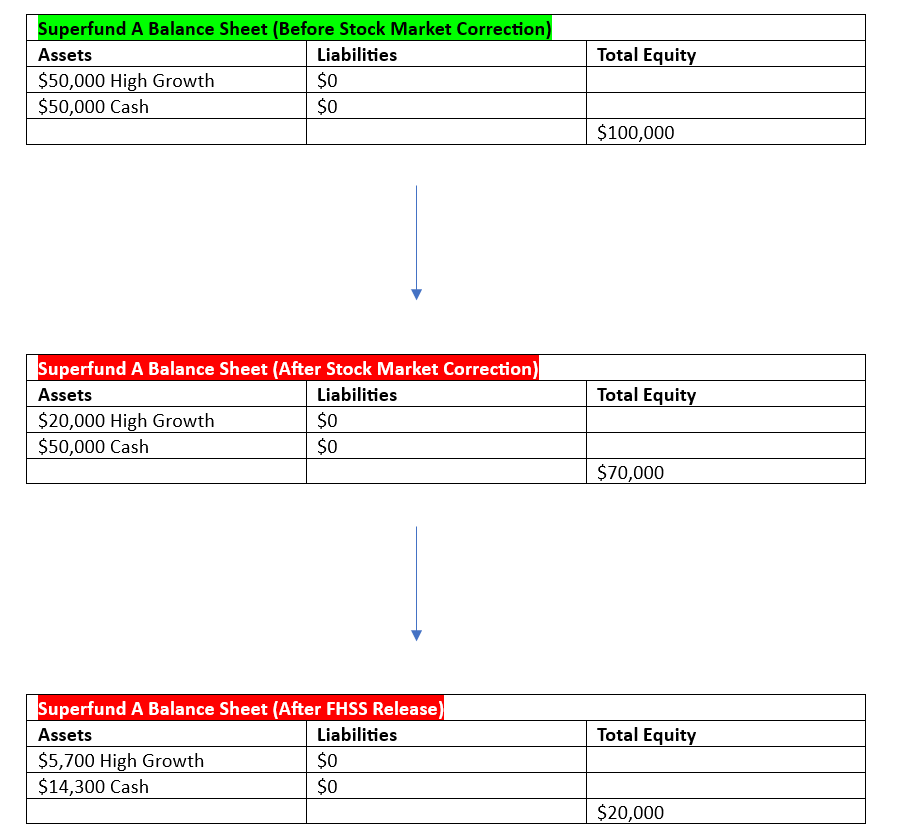

The table below illustrates this point, and the issues that we can run into, without proper structuring.

Suppose there is a big stock market crash and the high-growth investments plummet to $20,000, a 60% drop. You may only want to use the $50,000 cash option for the FHSS, but the release is apportioned. While you can rebalance the portfolio after the release, this crystalises the losses in the high growth allocation. It therefore hinders returns during the recovery of the stock market, since the superfund now holds fewer units of the high growth shares.

My Solution to this Dilemma

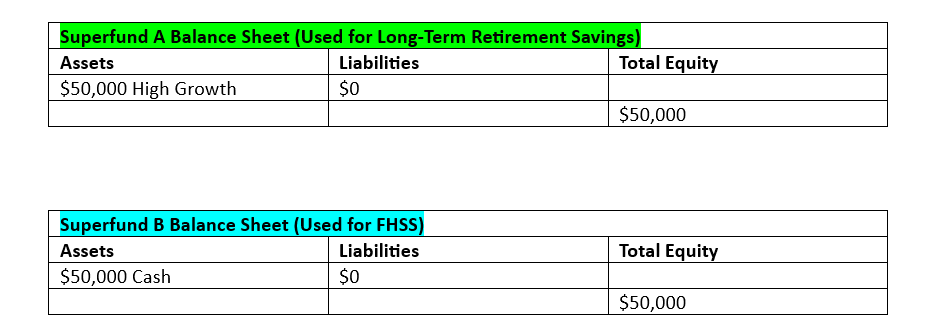

The best way I’ve found to avoid this dilemma is to have an entirely-separate superfund just for the FHSS. Basically, this is treated as a high-interest savings account. This also avoids the ‘mental accounting’ error that can be made when, within one superfund, investment decisions are mixed between long and shorter-term purposes. Even if FHSS contributions are invested only in cash, I believe it is possible to access the higher deemed earnings by rolling over additional amounts into the FHSS superfund. According to the ATO, the most recent shortfall interest charge (SIC) rate is 6.61% per year. The SIC rate is approximately the Cash Rate plus a 3% premium.

While the fees across having two separate superfunds makes this slightly more expensive, I think it is worthwhile for eliminating the risk of crystalised losses, avoiding the mixing of investment purposes, and the tax benefits. I have also rolled over a ‘surplus’ amount from my main superfund into the FHSS superfund to be a buffer, should the actual investment earnings fall short of the 6.61% SIC amount. This maximises the amount that I will be able to have released for a house deposit.

The information provided in this article reflects my personal approach and experience in managing my finances, including my use of the First Home Super Saver (FHSS) scheme. It is shared for general informational and educational purposes only and does not constitute financial advice. Readers should consider their own circumstances and seek independent financial, legal, or tax advice before making any financial decisions.